The Malaysian e-hailing market faces several challenges:

- Regulatory Environment: Government regulations and scrutiny of market competition

- Driver Compensation: Balancing competitive pricing with fair compensation for drivers

- Market Saturation: With 32 registered e-hailing apps, the market is becoming increasingly crowded

- Consumer Loyalty: Overcoming Grab's established user base and brand recognition

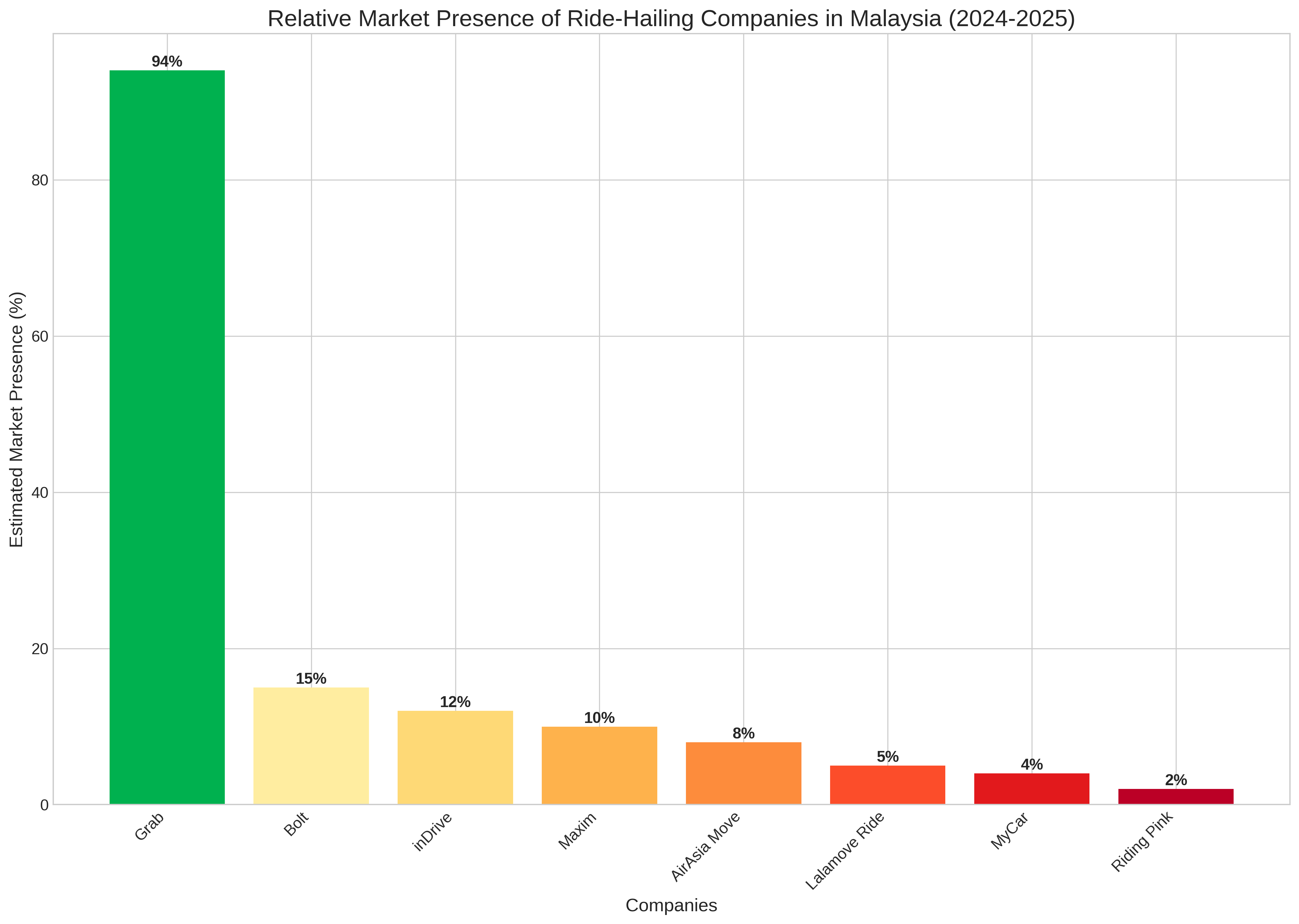

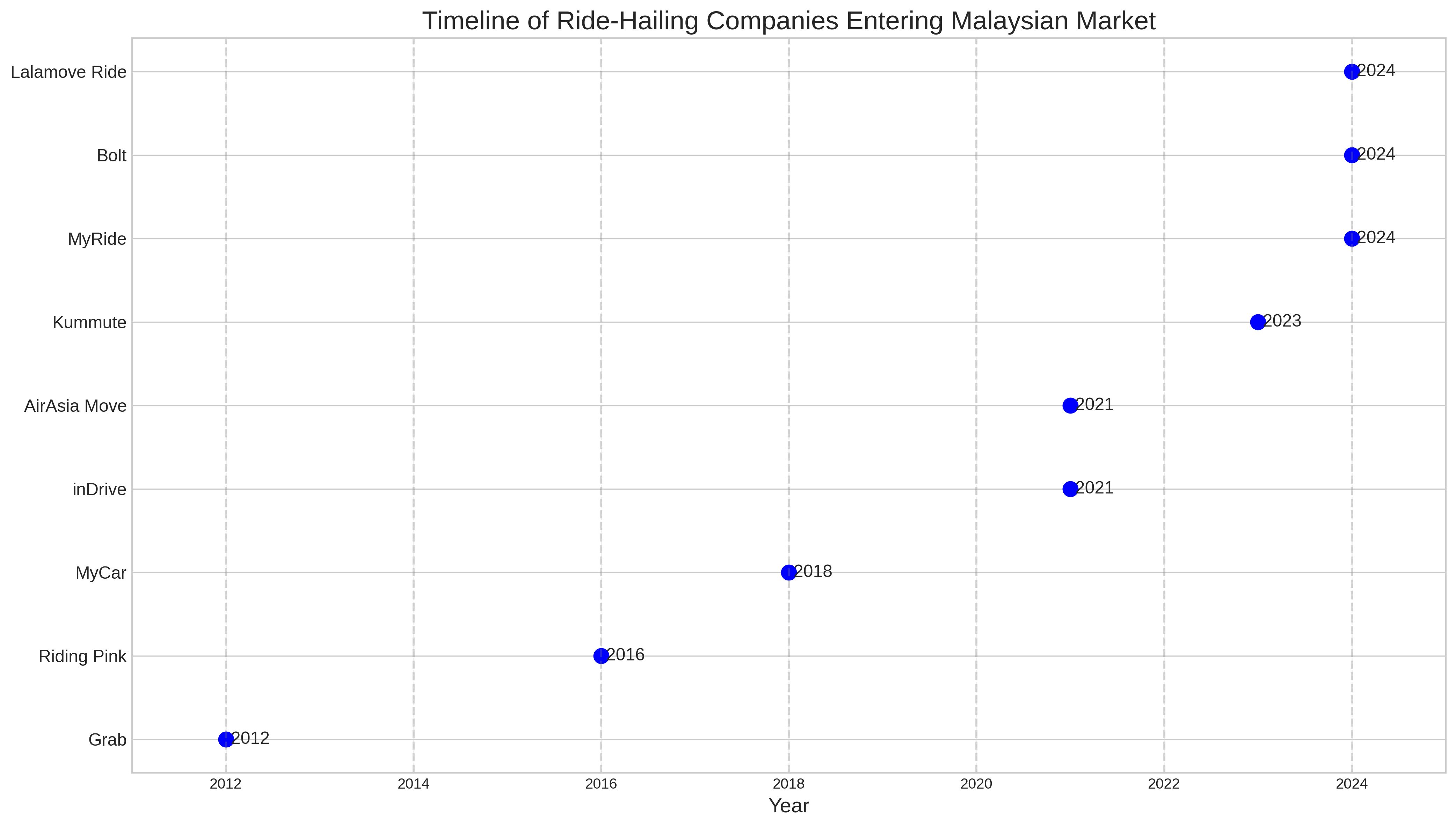

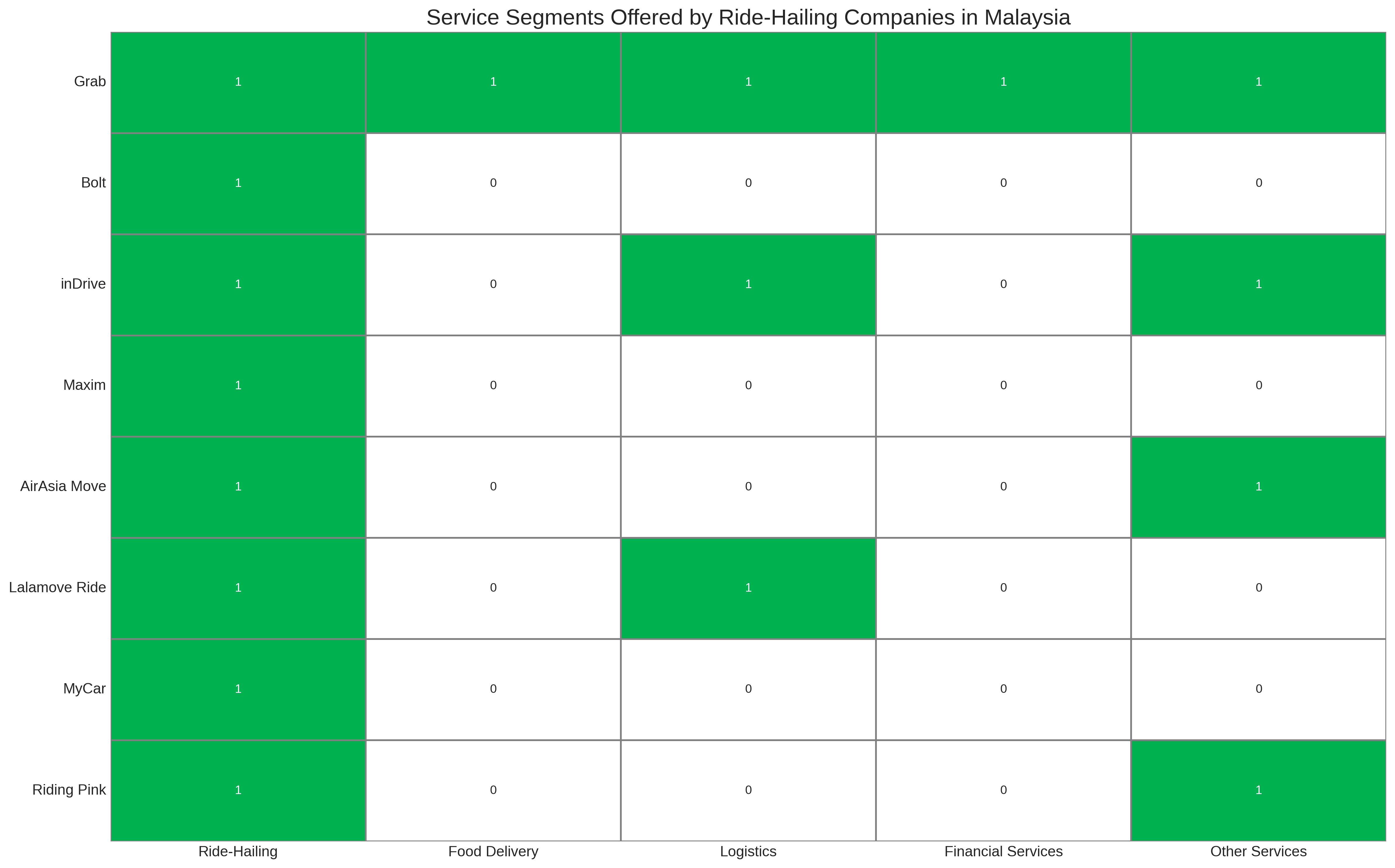

Looking ahead, while Grab is likely to maintain its dominant position in the near term, the increasing number of competitors and their diverse strategies suggest a gradual shift toward a more competitive landscape. New entrants with strong financial backing and innovative business models may gradually erode Grab's market share, particularly in specialized niches or underserved segments of the market.

Conclusion

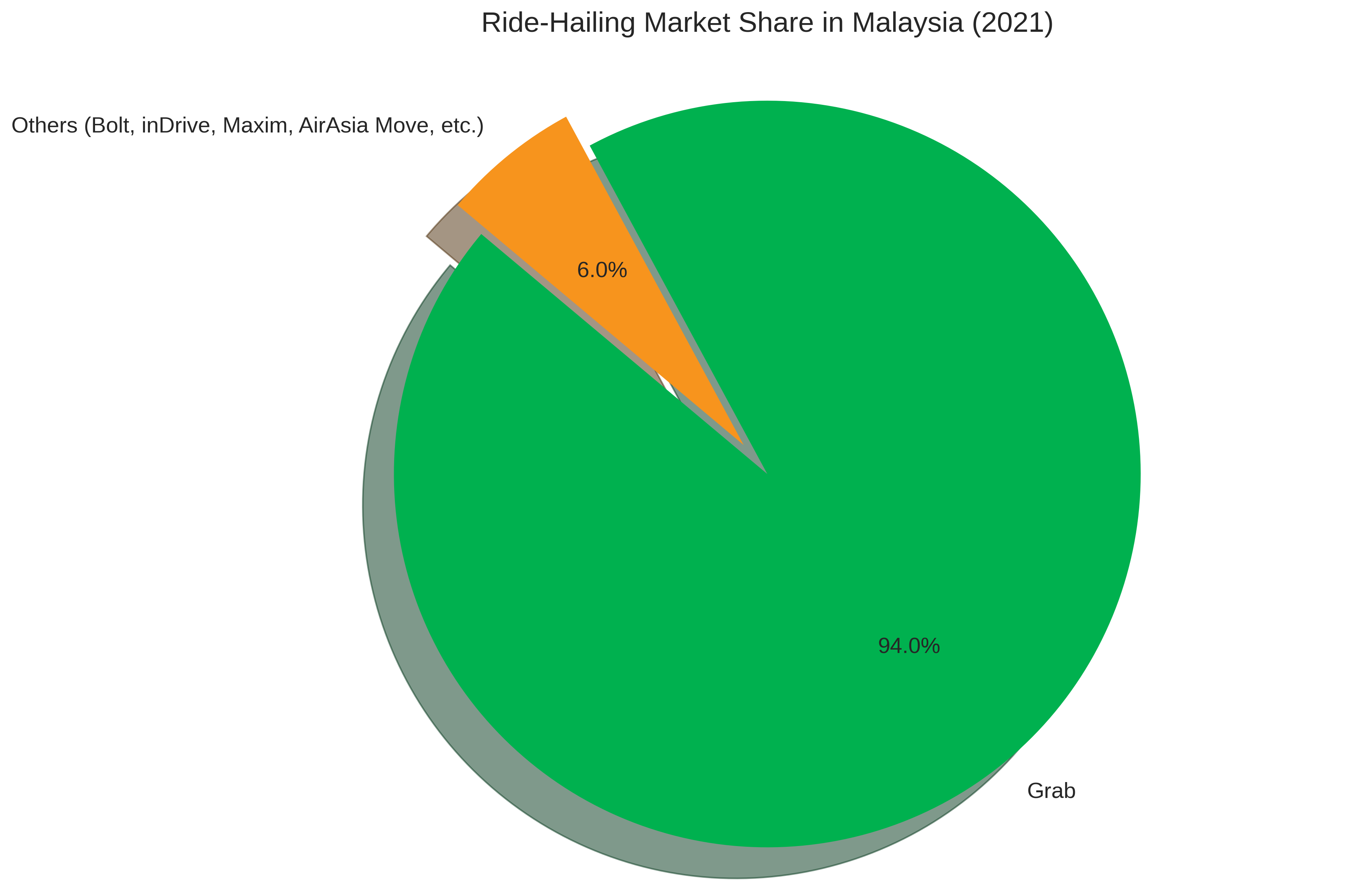

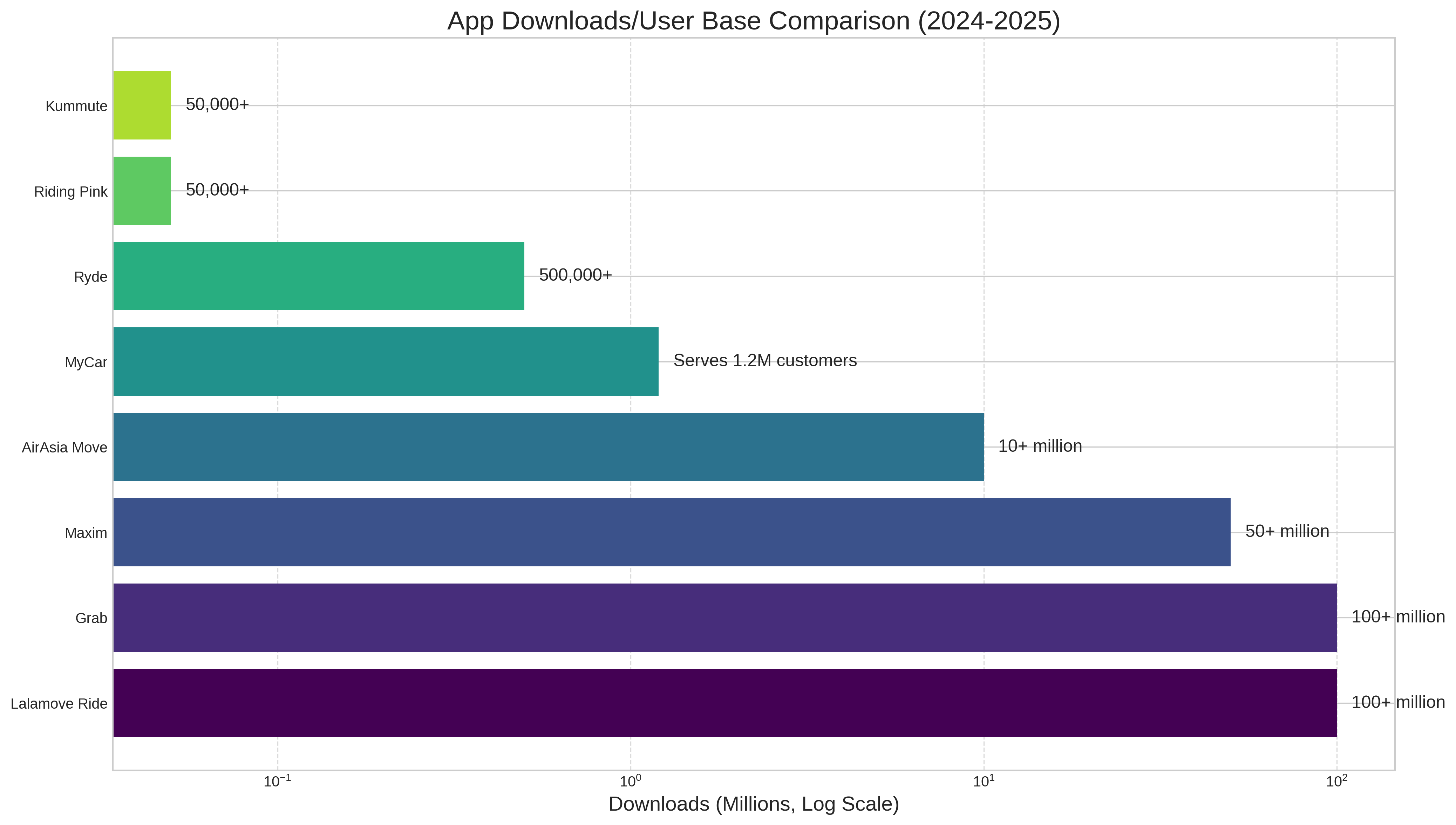

Grab maintains a commanding lead in Malaysia's ride-hailing market with approximately 94% market share. Its comprehensive service ecosystem, first-mover advantage, and strong brand recognition have helped it maintain this position despite the entry of numerous competitors.

While the market is becoming increasingly competitive with 32 registered e-hailing apps as of 2024, competitors face significant challenges in gaining substantial market share. However, the diverse strategies employed by these competitors and the evolving regulatory environment suggest potential for a more balanced market distribution in the future.